We’re resuming our educational blog about lymphedema. And we’re moving on from the last few posts about Medicare’s new coverage of lymphedema supplies & compression … almost. I had a recent incident worth mentioning.

Lymphedema Treatment Act Website

The Lymphedema Treatment Act (LTA) website has a list of durable medical equipment (DME) suppliers for lymphedema compression supplies & garments. It’s a good start, but it’s not entirely accurate. I’ve had a few inquiries from people who saw this business (Lymphedema Therapy Source) listed on the LTA website as a Medicare supplier. While this business just became an approved Medicare DME supplier this month, it can’t provide supplies or compression garments for people in states outside of Texas (not yet, anyway). That’s because most states (if not all) require a business to have a (DME) license in their state. And that usually requires a physical presence in that state.

The LTA advocacy team sent an email in Aug informing readers that Medicare has updated their online supplier search tool to include compression supplies. Unfortunately, Medicare (nor the Lymphedema Treatment Act website) contain an accurate list of businesses that can bill Medicare for lymphedema supplies.

August LTA newsletter. While both Medicare & the LTA lists include DME suppliers, Medicare’s list may not specialize in lymphedema products. And the LTA list may not include DME suppliers that can bill Medicare in your state (or at all).

How to Find a Billing Supplier

If you have insurance other than Medicare, your carrier may provide a list of suppliers for DME that are in-network. But like the Medicare list, they may not specialize in lymphedema products. The takeaway is: You should call before making a trip to visit a supplier to make sure they sell (on site) the item you’re seeking.

Here’s an example. A few weeks ago, a man came to my office building looking for an orthotic (with a doctor’s script in hand). His doctor had sent him to the building because another company (Accentus) is a local DME supplier who showed as in-network with his insurance. What the man didn’t know is the company specializes in diabetic supplies & that particular office is solely composed of backend office staff (i.e. it’s not a storefront). The girls in the office came looking for me assuming I could help him.

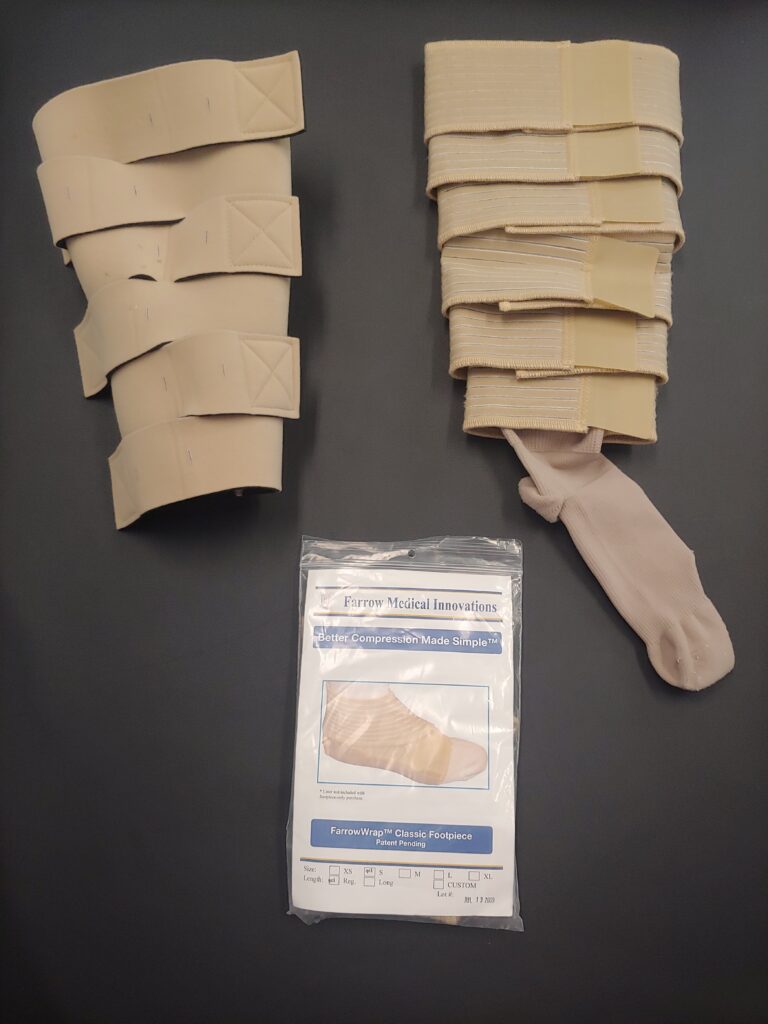

While this business can now bill insurance for DME, the specialty is lymphedema. Not orthopedic products like an ankle brace. I was able to read the script, explain the situation, & advise the man he needed to contact his insurance company again for a list of in-network suppliers. He then needed to call those companies to ensure they sold the ankle support he needed.

Conclusion

While it’s terrific that Medicare will now pay for lymphedema compression, treatment supplies & aids thanks to the efforts of the Lymphedema Treatment Act team, the downside is there’s a lot of confusion among beneficiaries as to how to find a supplier who can bill for their DME needs.

(First posted 09/16/24 for Aug.)