The past two months we reviewed compression pumps. Pumps can be an adjunct to therapy maintenance.6 But pump use shouldn’t be a standalone plan for lymphedema treatment or maintenance. What is the recommended maintenance program for lymphedema?

Phase I: Decongestive Lymphedema Treatment

First, a person should complete phase I (decongestion) which involves complete decongestive therapy (CDT). CDT is composed of:

- manual lymph drainage

- multi-layer short-stretch bandaging

- skin care

- decongestive exercise.

Duration

The duration of this phase depends on the severity of lymphedema. It also depends on the frequency of treatment (which should be daily & bandages should remain on until the next therapy session).4 And it depends on comorbidities (such as vein disease, heart failure, renal failure, etc.) being diagnosed & properly treated.5

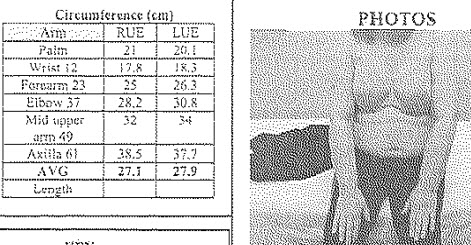

If a person is in stage I lymphedema, CDT generally lasts about 2 weeks. If stage II lymphedema (depending on how advanced within stage II), CDT lasts approximately 4-6 weeks. If stage III lymphedema, CDT may last 6-8 weeks or more (& it’s recommended to be treated several times a day according to Foldi).1 Below is a reference for the stages.

If a person is in stage I lymphedema, CDT generally lasts about 2 weeks. If stage II lymphedema (depending on how advanced within stage II), CDT lasts approximately 4-6 weeks. If stage III lymphedema, CDT may last 6-8 weeks or more (& it’s recommended to be treated several times a day according to Foldi).1 Below is a reference for the stages.

Lymphedema Stages

- Stage I (the reversible stage) – It’s caused by accumulation of interstitial (lymph) fluid.2 And it’s characterized by pitting edema & reduction in swelling with elevation. There isn’t usually pain in lymphedema,3 but there may be pain in this stage associated with early congestion.

- Stage II (the spontaneously irreversible stage) – It’s caused by excess growth of connective (scar) tissue. It’s characterized by fibrosis & fat tissue growth. The swelling becomes more hard & doesn’t go down with elevation. There may be discoloration (brownish discoloration) to the involved tissue.

- Stage III (elephantiasis) – It’s caused by the accumulation effect of stage II leading to extensive fibrosis & fat tissue growth. There are deep creases, fungal infections, recurrent cellulitis infections & some people may even become immobile.

In my experience, people get tired of bandaging after 2 weeks. They often seek shortcuts. For example:

– ending therapy before fibrosis is adequately reduced (note: some fibrosis will likely persist if a person initiates therapy during stages II or III of their lymphedema)7

– removing bandages before the next session

– using only (1) set of bandages, not washing bandages between sessions for better recoil & compression

– canceling a session here & there, missing consistent daily treatment.

These behaviors impact outcome. Of course, there can also be other “hiccups” during therapy. For example, a pressure wound develops & must be addressed, compression slips down between sessions or gets wet during toileting or bathing. These events are more likely when people aren’t treated as they are in Germany (i.e. inpatient hospitalization with focused, daily lymphedema therapy).8 Sometimes things just happen. But these events can prolong phase I & expectations should be clear in advance to avoid added disappointment.

Next month, we’ll pick up with phase II in part 2 of this blog on Lymphedema Maintenance. (References will be cited in that post.)